Vehicle Depreciation Rules 2024 – Some assets which accumulate depreciation are: Vehicles Furniture Computers Equipment In accordance with accounting rules, companies must depreciate these assets over their useful lives. . Under standard depreciation rules, businesses deduct costs over several it was often used to write off the purchase of qualifying vehicles. The positive impact of Section 179 has been reduced .

Vehicle Depreciation Rules 2024

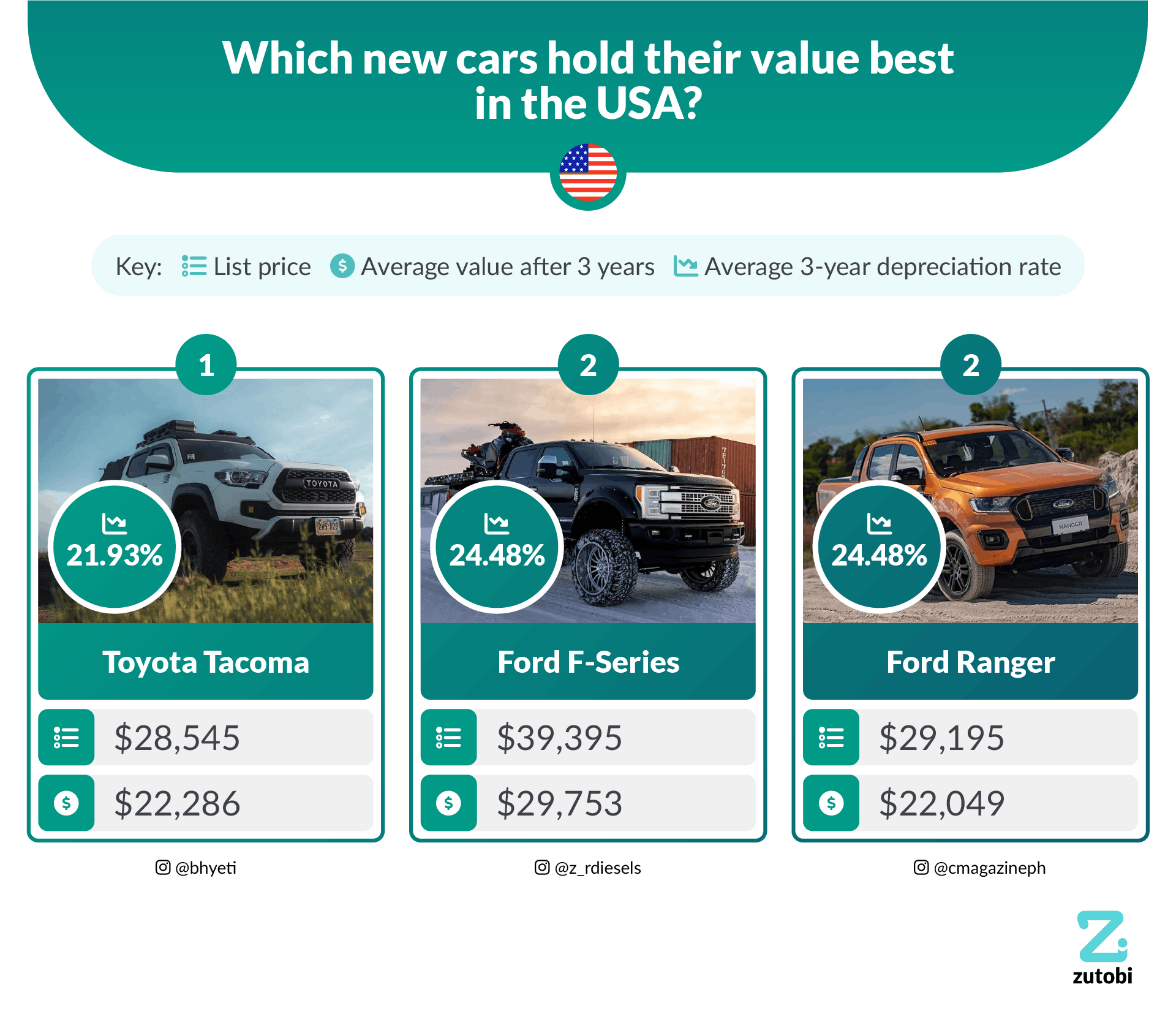

Source : www.visualcapitalist.comThe 2024 Motoring Depreciation Report | Zutobi

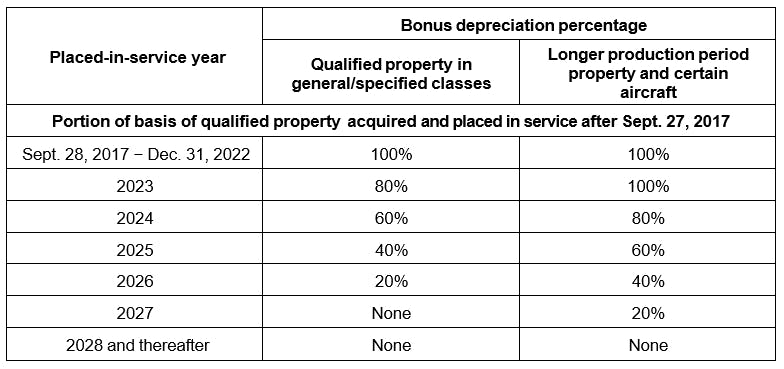

Source : zutobi.comUnderstanding Tax Depreciation Rules for 2023 and 2024: Bonus

Source : hoodcpas.comBonus depreciation rules, recovery periods for real property and

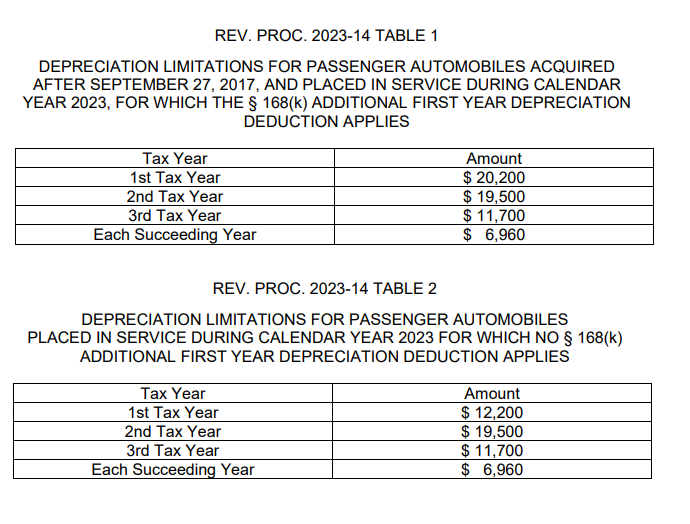

Source : www.bakertilly.comIRS Updates Auto Depreciation Limits for 2023

Source : www.eidebailly.comTax Benefits For Your Small Business With Jeep® Vehicles

Source : www.jeep.comIRS Updates Auto Depreciation Limits for 2024

Source : www.eidebailly.comSection 179 Vehicles Infographic Balboa Capital

Source : www.balboacapital.comUpdate] Section 179 Deduction Vehicle List 2024 | XOA TAX

Source : www.xoatax.comRetailers’ hopes for used car prices in 2024: More consistency

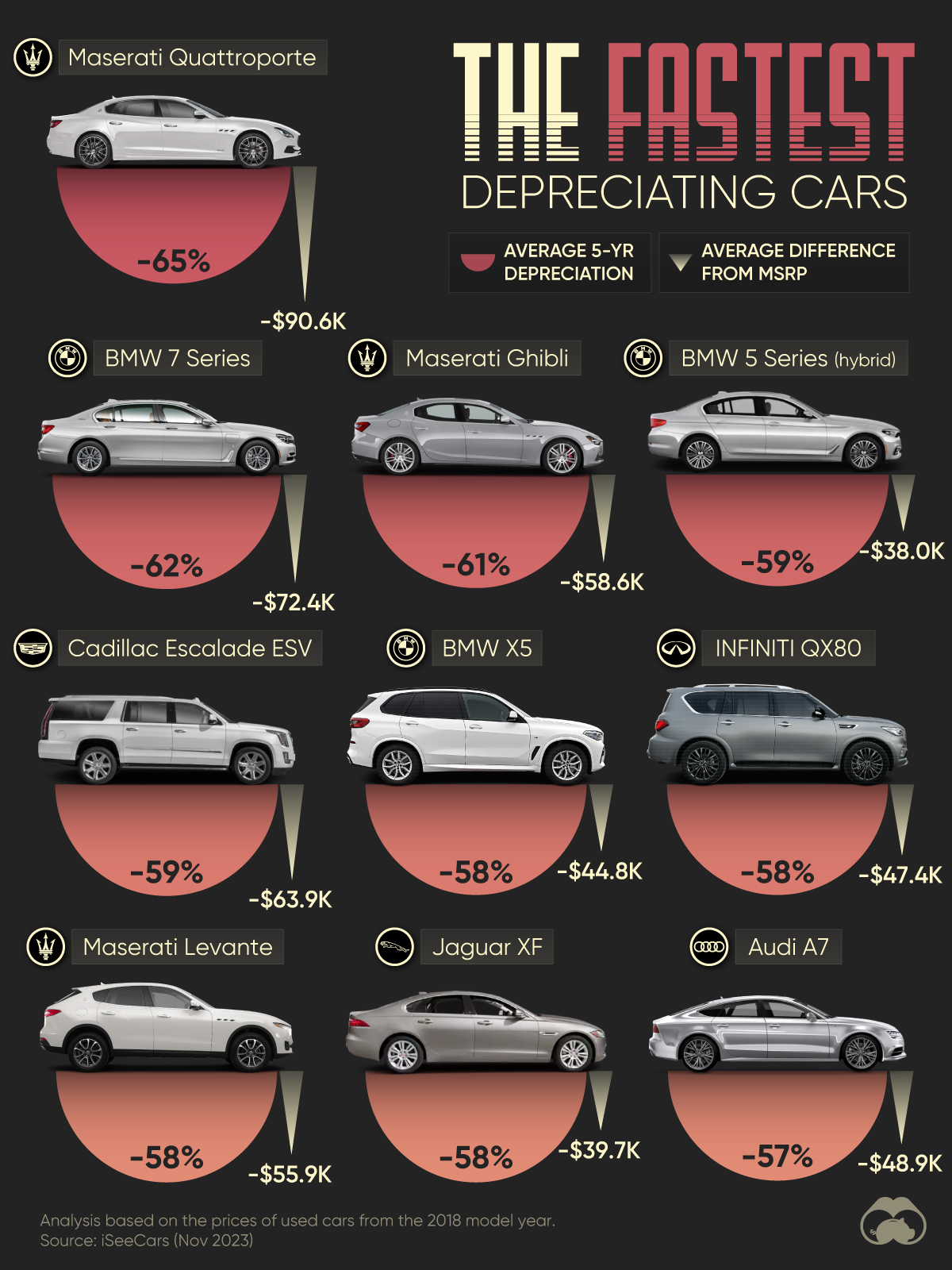

Source : www.autonews.comVehicle Depreciation Rules 2024 Ranked: Which Cars Depreciate the Fastest?: Hey folks, buckle up because we’re about to delve deeper into the mysteries of car depreciation drive cautiously and follow traffic rules. Image Credit: Shutterstock. Skipping the Check . Lease payments are almost always lower than loan payments because you’re paying only for the vehicle’s depreciation during the lease term, plus interest charges (called rent charges), taxes .

]]>